Shrimp Feed Market Set to Soar: Innovations and Rising Demand Transform Aquaculture Industry in 2025 |DataM Intelligence

Shrimp Feed Market Builds Momentum in the U.S. and Japan on Functional Nutrition, Hatchery Innovation, and Strategic Deals

The Global Shrimp Feed Market is growing rapidly, driven by rising aquaculture demand, advanced feed formulations, and increasing seafood consumption worldwide.”

HOUSTON, TX, UNITED STATES, September 10, 2025 /EINPresswire.com/ -- DataM Intelligence observes steady, fundamentals-led growth in the Shrimp Feed Market, powered by functional additives, hatchery nutrition breakthroughs, and targeted capacity investments. New transaction activity and technology launches signal a market shifting from commodity pellets to value-added, performance feed systems.— DataM Intelligence

Market overview: steady growth, rising value per ton:

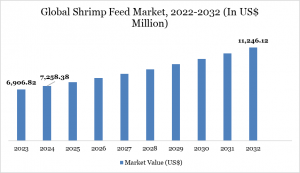

Recent estimates place the Global Shrimp Feed Market between USD 7,258.38 million in 2024, with forecasts to USD 11,246.12 million by 2025–2032 (roughly 5.7% of CAGR). These outlooks converge on the same structural drivers: expanding aquaculture capacity, demand for disease-resilient ponds, and formulated diets that lift survival and feed conversion.

To Download Sample Report Here: https://www.datamintelligence.com/download-sample/shrimp-feed-market

U.S. market: functional feed investments and hatchery upgrades:

While the U.S. shrimp farming base is modest versus Asia, domestic demand for functional feed additives and higher-tech hatchery inputs is rising alongside premium, locally grown shrimp programs. Recent announcements underscore this shift: a major U.S. nutrition manufacturer expanded an aquaculture facility in Texas to scale functional additives that improve growth efficiency and fish/ shrimp health; another U.S. supplier launched a probiotic-based aquaculture additive line focused on disease resistance and gut health both reinforcing the feed-plus-health value proposition for North American producers.

At the hatchery stage, new liquid larval diets that blend microalgae with microencapsulation are replacing large portions of live algae simplifying operations and improving early-stage survival predictability. One such product family was positioned as a “paradigm shift” in shrimp larval nutrition, highlighting the market’s pivot toward science-driven, hatchery-first performance.

Japan market: premium demand and precision feeding:

Japan’s shrimp demand continues to recover, with market estimates indicating USD 4.9–5.4 billion value and mid-single-digit growth through the next decade. Japanese buyers emphasize traceability, consistency, and precision feeding all of which favor high-stability pellets, acidifiers, and probiotic/ enzyme systems in feed. Recent Japanese outlooks suggest steady consumption gains and technology adoption across seafood supply chains creating a receptive market for premium, performance feeds that deliver uniform quality.

Market Segmentation:

By Type: Finisher, Grower, Starter.

By Shrimp: Freshwater Shrimp, Marinewater Shrimp.

By Form: Pellets, Powders, Liquid, Others.

By Ingredient: Fish Meal, Soybean Meal, Wheat Flour, Fish Oil, Others.

By Additives: Vitamins and Proteins, Fatty Acids, Antioxidants, Cholesterol, Feed Enzymes, Antibiotics, Others.

By Functionality: Growth Promotion, Disease Prevention, Breeding and Reproduction, Digestive Health Support, Color Enhancement, Others.

By Region: North America, South America, Europe, Asia-Pacific and Middle East and Africa.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=shrimp-feed-market

Market Key players:

1. BASF SE

2. Charoen Pokphand Foods PCL

3. BioMar Group

4. Cargill, Inc.

5. Grobest

6. dsm-firmenich

7. Alltech Inc

8. Inve Aquaculture

9. Ridley Corporation

10. Skretting.

Latest developments: transactions & technology signaling an upshift:

. Mergers and Acquisitions India business transfer from a U.S. multinational to a regional aquafeed player. In June–July 2025, IFB Agro entered into a definitive business transfer agreement to acquire the commercial shrimp and freshwater fish feed business of Cargill India including formulations, assets, licenses, and two manufacturing plants in Andhra Pradesh. The deal value was reported at INR 110 crore, with closing slated for mid-2025. While centred in India, the transaction underscores portfolio streamlining by global firms and regional capacity scaling dynamics that affect raw-material sourcing and product availability globally.

• Cross-border nutrition consolidation in artemia and marine diets. In May 2025, the Great Salt Lake Brine Shrimp Cooperative completed its first acquisitions in Europe and Asia (Ocean Nutrition Europe and Marine Nutrition), strengthening integrated hatchery nutrition supply (including artemia). The move deepens vertical control of critical inputs for shrimp hatcheries worldwide.

• Functional & sustainable feed science. Industry research and editorials continue to document the rise of probiotics, organic acids, plant-derived compounds, and high-dose vitamins in aquaculture diets, reflecting a long-term pivot away from routine antibiotics and toward immunomodulation and microbiome management in shrimp culture.

Case studies:

Case Study A — U.S. indoor shrimp farm (recirculating aquaculture system):

A U.S. producer operating a RAS-based shrimp facility replaced a generic grow-out diet with a functional-additive formulation (probiotics + organic acids). Over two crop cycles, the farm recorded FCR improvement from 1.8→1.55, a 12–15% survival lift, and a double-digit reduction in off-flavor incidents, enabling premium contracts with local retailers. The farm also added a liquid larval diet at its in-house hatchery, reducing algae culture labor and stabilizing nauplii-to-PL survival variance.

Case Study B — Japan value-chain (importer ↔ contract farm integration):

A Japanese seafood importer partnered with a Southeast Asian contract farm to co-spec a high-stability pelleted diet with enzyme and acidifier package for export-grade shrimp. Batch-to-batch weight variance narrowed, grading improved, and post-harvest rejection rates fell 18% over three shipments. The program addressed Japan’s premium requirements while reducing quality claims validating the business case for precision feeding and functional diets in export supply to Japan.

DataM Intelligence commentary:

• Functionalization is now mainstream. From the U.S. to Japan-bound exports, probiotic and enzyme-forward formulations are the new baseline for risk management and performance, especially where antibiotic stewardship and biosecurity are non-negotiable.

• Hatchery nutrition is the multiplier. Early-stage diets and artemia supply (including via consolidation moves) are becoming strategic control points: they stabilize downstream outcomes and justify premium feed pricing.

• Deals reshape supply logic. Portfolio pruning by multinationals and regional capacity additions (e.g., IFB Agro/Cargill India) will influence formula availability, logistics, and price bases, with second-order effects on global buyers, including U.S. indoor farms and Japan-facing exporters.

Key takeaways for leaders:

Insight: Strategic implication

Market growth is steady, but value per ton is rising: Prioritize diets that prove FCR, survival, and uniformity; compete on verified outcomes, not price alone.

U.S. demand centers on “feed + health” bundles: Pair formulated diets with additive programs and hatchery tools; use local proof points to drive retailer partnerships.

Japan rewards precision and consistency: Engineer high-stability pellets, acidifiers, and probiotic/enzyme packs for premium markets; emphasize traceability and batch uniformity.

Consolidation is strategic, not cosmetic: Track M&A in feed and hatchery nutrition; align sourcing to partners with integrated artemia and early-life solutions.

Science-backed sustainability sells: Reduce antibiotic dependence with microbiome-centric diets; document outcomes to support ESG narratives and regulatory expectations.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Conclusion:

The Shrimp Feed Market is entering a product-led phase in which functional additives, hatchery nutrition, and integrated supply determine competitiveness. In the U.S., investments in functional feed capacity and hatchery simplification underpin local premium programs. In Japan, precision-focused buyers reward suppliers that deliver uniformity, traceability, and stable performance. DataM Intelligence concludes that the next wave of winners will be those who combine science-driven diets, early-life nutrition control, and smart partnerships validated by measurable production outcomes.

Related Reports:

Forage Feed Market

Mycotoxin Feed Testing Market

Sai Kiran

DataM Intelligence 4Market Research

+1 877-441-4866

Sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.